There shouldn't be any need to do anything different in Cointracking.

The three letter code for KVT hasn't changed and 1 KVT on Stellar is the same as 1 KVT on Ethereum.

Future transfers and trades will have KVT fees rather than ETH.

Here is a simplified CSV export that just focuses on the transactions around

The blue shaded entry would have had to have been created manually, while the others would be generated by the KMS.

I added the text in the Comment field for clarity.

I loaded that file into a fresh Cointracking account via the Kinesis CSV import page,

Here are the Transactions in Cointracking:

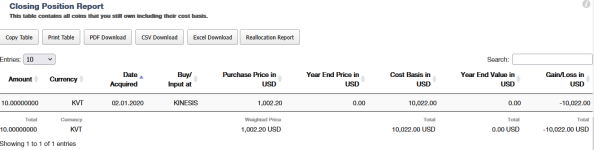

Here's the Closing Position from a tax report using the FIFO method and USD as currency.

The Trade transaction established the closing balance.

Deposit and Withdrawal transactions are ignored for these purposes as they are assumed to be transfers between own accounts/wallets.

They therefore don't increase/decrease balances or affect capital gains/income calculations.

For completeness, I manually added a Withdrawal from hw wallet as even if the ERC20 KVT in the wallet were actually retired, conceptually this balances where the deposit has come from.

(withdrawal from hw wallet, deposit to KMS).

This withdrawal is not needed and won't have any effect on tax calculations.

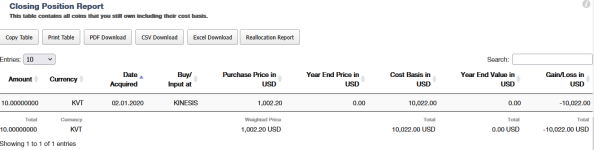

Then re-calculated and re-ran the tax report.

Here again is the Closing Position report.

The three letter code for KVT hasn't changed and 1 KVT on Stellar is the same as 1 KVT on Ethereum.

Future transfers and trades will have KVT fees rather than ETH.

Here is a simplified CSV export that just focuses on the transactions around

- a purchase of KVT

- subsequent transfer to a hardware wallet

- the recent crediting of KMS accounts for balances held in a linked hardware wallet

The blue shaded entry would have had to have been created manually, while the others would be generated by the KMS.

I added the text in the Comment field for clarity.

I loaded that file into a fresh Cointracking account via the Kinesis CSV import page,

Here are the Transactions in Cointracking:

Here's the Closing Position from a tax report using the FIFO method and USD as currency.

The Trade transaction established the closing balance.

Deposit and Withdrawal transactions are ignored for these purposes as they are assumed to be transfers between own accounts/wallets.

They therefore don't increase/decrease balances or affect capital gains/income calculations.

For completeness, I manually added a Withdrawal from hw wallet as even if the ERC20 KVT in the wallet were actually retired, conceptually this balances where the deposit has come from.

(withdrawal from hw wallet, deposit to KMS).

This withdrawal is not needed and won't have any effect on tax calculations.

Then re-calculated and re-ran the tax report.

Here again is the Closing Position report.