An email with the title

Kinesis integrates with CoinTracking platform

announces the availability of a new import page for Kinesis files at cointracking.info

The body contains the title

Simplified reporting with Cointracking

The Cointracking CSV extract file contains KAU and KAG as the core Kinesis currencies.

Cointracking uses KAU2 for Kinesis Gold and is able to find historical prices back to when KAU was added to coinmarketcap.com.

There is a link in the email to a Kinesis specific import page.

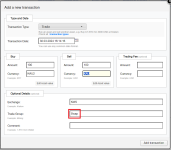

It's also included in the Export CSV window.

It's important to use this for the benefits below.

A key feature of the new import page is that KAU is swapped to KAU2 as part of the import process.

This means that Cointracking will automatically price Income, Deposit, Withdrawal etc records (Trade records were already priced by the other side of the trade).

When doing your taxes, this means that only records prior to the coinmarketcap.com add date need to be manually priced. It may be worth double checking records on the add dates as I don't know what time of day they were added.

The coinmarketcap.com add dates were:

Kinesis integrates with CoinTracking platform

announces the availability of a new import page for Kinesis files at cointracking.info

The body contains the title

Simplified reporting with Cointracking

The Cointracking CSV extract file contains KAU and KAG as the core Kinesis currencies.

Cointracking uses KAU2 for Kinesis Gold and is able to find historical prices back to when KAU was added to coinmarketcap.com.

There is a link in the email to a Kinesis specific import page.

It's also included in the Export CSV window.

It's important to use this for the benefits below.

A key feature of the new import page is that KAU is swapped to KAU2 as part of the import process.

This means that Cointracking will automatically price Income, Deposit, Withdrawal etc records (Trade records were already priced by the other side of the trade).

When doing your taxes, this means that only records prior to the coinmarketcap.com add date need to be manually priced. It may be worth double checking records on the add dates as I don't know what time of day they were added.

The coinmarketcap.com add dates were:

- KAU 14th April 2023

- KAG 19th April 2023

Last edited: