Decaf's new version now supports Stellar send.

-On-ramp crypto via Solana or Stellar or cash via Moneygram Cash-in (See below)

-On-ramp fiat via ACH: ask support for a US account. Do KYC.

-Anyone can send US$ to that account, including yourself or a company.

-Receive USDC$ equivalent in your wallet 1 for 1.

-Send USDC$ to either a Solana or Stellar address, Kinesis in this case, without fees.

-Off-ramp UDSC 1:1 to a US$ bank account or in Euro in SEPA countries, without fees.

-Off-ramp in supported local currencies via Moneygram Cash-out.

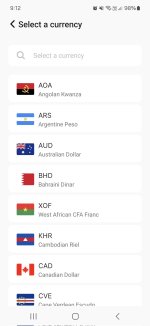

-Off-ramp via OTC to bank accounts in COP, MXN, BRL, ARS, PEN, CAD$.

Voila.

*Edit: Wise works both for on-ramping & off-ramping to US$ accounts.

**Edit2: Memo is now supported on Stellar send.

***Edit3: Added OTC info

-On-ramp crypto via Solana or Stellar or cash via Moneygram Cash-in (See below)

-On-ramp fiat via ACH: ask support for a US account. Do KYC.

-Anyone can send US$ to that account, including yourself or a company.

-Receive USDC$ equivalent in your wallet 1 for 1.

-Send USDC$ to either a Solana or Stellar address, Kinesis in this case, without fees.

-Off-ramp UDSC 1:1 to a US$ bank account or in Euro in SEPA countries, without fees.

-Off-ramp in supported local currencies via Moneygram Cash-out.

-Off-ramp via OTC to bank accounts in COP, MXN, BRL, ARS, PEN, CAD$.

Voila.

*Edit: Wise works both for on-ramping & off-ramping to US$ accounts.

**Edit2: Memo is now supported on Stellar send.

***Edit3: Added OTC info

Last edited: