You're asserting that Kinesis is completely unregulated. I believe you are incorrect in that assertion.

It's not regulated by the FDIC as it's not a US Bank - maybe that's all you need? Are there any other regulatory authorities you trust other than the FDIC?

So you use "9 banks and 2 credit unions," and rely on FDIC regulators to secure your assets in those institutions. Fair enough, most do and don't do any due diligence beyond that.

But you want Kinesis, which is...

- less established

- working on something brand new in the world

- a much more ambitious project than a traditional bank

- trying to execute in most of the world simultaneously

- likely has fewer resources than many of those banks

...to provide more transparency than any of those entities. And when you get information you don't understand you want them to provide tutorials and walk you through it.

It just seems like you're using two standards here: there's one standard for Kinesis, and another standard for the dozen other financial entities you use. And that really confuses me.

All I'd like to see is some consistency here. That's all - as far as I can tell Kinesis is the most transparent organization in this space, and as a reaction to that transparency you say "give me more," or "you've given me too much, and I don't understand it, so please delegate a Kinesis employee to walk me through it."

Maybe that's reasonable. It just seems there's a higher burden on the small upstart company trying to do everything right than there is on the rapscallions of the industry (which let them get away with so much) or on the established entities which, let's be honest, don't always make rational decisions with their client money. I think a significant number of the large commercial banks are, on paper, if required to mark their assets to market, insolvent. Especially now that the carry trade in bonds has collapsed, but participants have not yet been forced to account for the revaluations of the bonds involved.

But they get a pass.

As to my enthusiasm for this project: yes, I'm quite enthusiastic. But I trust that that metal is there (because there are third-party physical audits), and I trust that that metal matches the amount of metal on the blockchain (because we've looked). I trust that Kinesis is a bailee because they say they are, and if that's a lie it's

very actionable should things go sideways.

I trust that KAU and KAG I own can be turned into physical metal and delivered, or converted at close to market rates and wired to me. I know that the KVT I own are speculative and depend on Kinesis delivering

big partnerships in a way that, to date, they haven't proven they can.

Kinesis isn't my local branch of Wells Fargo - I'll give you that. But I accept what it is, and if I hadn't I wouldn't have signed up and transferred money in.

You didn't actually need to tell me that - it's been pretty clear.

But I'm getting the feeling that there's not much that can be done to restore your trust in this system at this point.

You know the metal is in the vault. You know (or mostly know) that the metal on the vaults matches what's on the blockchain. You're not quite sure how all this blockchain stuff ties together and feeds the calculations, but it's pretty clear at this point that the numbers match. And as a result you still don't trust the blockchain.

You've read the agreements on the Kinesis web site that say metal

is titled to the holders, but now you're not sure that you believe them.

You're not sure Kinesis can be trusted because they've got a different entity for each different regulatory regime where they're trying to do business, while companies like Citigroup have...hundreds of sub-companies and that's fine?

I don't understand the apparent cognitive dissonance.

This isn't meant as an attack. But I'm not sure what Kinesis can say or do to provide you the assurances and comfort you're looking for.

Derek,

For you , and only a few more on this board will I continue to engage a bit more.

One by one:

1. You're asserting that Kinesis is completely unregulated. I believe you are incorrect in that assertion.

Reference your DD beliefs, I'd love to be further informed.

2. It's not regulated by the FDIC as it's not a US Bank - maybe that's all you need? Are there any other regulatory authorities you trust other than the FDIC?.....So you use "9 banks and 2 credit unions," and rely on FDIC regulators to secure your assets in those institutions. Fair enough, most do and don't do any due diligence beyond that.

Not sure exactly where to start or go here.

In the US there multiple types of traditional Banks that operate in the US

Many are regulated by Office of the Comptroller of the Currency, overseen by the FDIC up to 500K insurance. Provides a lot of Oversight, and OPEN BOOKS on a regular basis.

The Credit Unions are regulated by the National Credit Union association , again insured up to 500K default insurance , offered again because of a lot of Oversight, and OPEN BOOKS on a regular basis.

Is this absolute assurance ?No Hence in large why I have outlined my hedge plan to you in case of the 2008 repeat.

In reference to this International Corporates Hydra (Kinesis), we are investing in, I have No Idea of the the Legal Lawful structure ,( been asking for answers well over a year), Much less has anyone seen a financial audit. How is one to know how the funds are managed or handled? Have you piad more than cursory attention to FTX Or the other implosions? How do we know that millions of dollars are not shuffled between companies as in those instances? 388

3.But you want Kinesis, which is...

less established

working on something brand new in the world

a much more ambitious project than a traditional bank

trying to execute in most of the world simultaneously

likely has fewer resources than many of those banks

...to provide more transparency than any of those entities.

More transparency? Seriously?

4.And when you get information you don't understand you want them to provide tutorials and walk you through it.

Yes members of the boards have been gracious with their time

5.It just seems like you're using two standards here: there's one standard for Kinesis, and another standard for the dozen other financial entities you use. And that really confuses me.

The absurdity of this statement, and the one below, is Breathtaking

6.I will suggest to you to be careful of letting your enthusiasm for what you want a project to be, cloud your judgement of what the project truly is. .

All I'd like to see is some consistency here. That's all - as far as I can tell Kinesis is the most transparent organization in this space, and as a reaction to that transparency you say "give me more," or "you've given me too much, and I don't understand it, so please delegate a Kinesis employee to walk me through it."

Maybe that's reasonable. It just seems there's a higher burden on the small upstart company trying to do everything right than there is on the rapscallions of the industry (which let them get away with so much) or on the established entities which, let's be honest, don't always make rational decisions with their client money. I think a significant number of the large commercial banks are, on paper, if required to mark their assets to market, insolvent. Especially now that the carry trade in bonds has collapsed, but participants have not yet been forced to account for the revaluations of the bonds involved.

Esoteric speculation.

7.But they get a pass.

As to my enthusiasm for this project: yes, I'm quite enthusiastic. But I trust that that metal is there (because there are third-party physical audits), and I trust that that metal matches the amount of metal on the blockchain (because we've looked). I trust that Kinesis is a bailee because they say they are, and if that's a lie it's very actionable should things go sideways.

Beleive what you will, it's whole of the the law as it is here

8. I trust that KAU and KAG I own can be turned into physical metal and delivered, or converted at close to market rates and wired to me. I know that the KVT I own are speculative and depend on Kinesis delivering big partnerships in a way that, to date, they haven't proven they can.

Kinesis isn't my local branch of Wells Fargo - I'll give you that. But I accept what it is, and if I hadn't I wouldn't have signed up and transferred money in.

"AmaLlulLa said:

However, My Trust in the system, both in the blockchain, the assurances of title of the PM's, and the liquidity of whatever the Multi hydra headed business structure is, has faltered....... 388

You didn't actually need to tell me that - it's been pretty clear.

I'm trying, but failing I'm sure

9. But I'm getting the feeling that there's not much that can be done to restore your trust in this system at this point.

You know the metal is in the vault.

I don't know that. The last non-delivered as promised audit had a third of it attested by transit companies in Turkey. I may of even seen some of it in the back of Jim Forsythes car for all I know, because I can't get a answer if The Bullion Stores Inventory is included in the audit. And I am still waiting for the promised explanation from the CEO for the defeciencies in the Audit (sorry, Trustable companies don't respond with posts on ReddIt. Hard Fail) So no Derek, I don't know, and I Do Not Trust.

10. You know (or mostly know) that the metal on the vaults matches what's on the blockchain.

You're not quite sure how all this blockchain stuff ties together and feeds the calculations, but it's pretty clear at this point that the numbers match.

And as a result you still don't trust the blockchain.

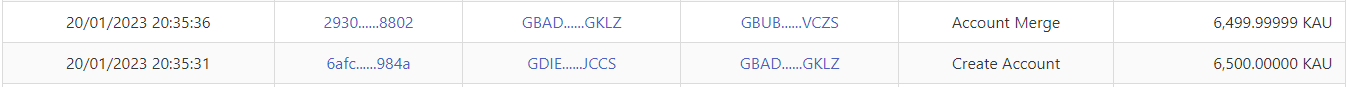

My ignorance of the technicalities of Blockchain, and Kinesis's utilization of this specific blockchain is immense. My Naïve assumption engaging the Kinesis project, was that with Any blockchain application,( Particularly this one because kinesis says so), there would be a relatively doable way for a non expert to see the open proof of it's integrity, and of experts to mathematically verify it with close inspection. That's the WHOLE POINT of BlockChain technology as I Understand it. Frankly, I was startled when an Obvious fact was pointed out: These audits verified By Bureau Veritas, confirmed the presence of the metals (over three days and ignoring the 1/3 held by transit companies FWIW) , BUT did not "confirm" the Token circulation. That was done by the CEO, and unless I missed it, we are still waiting for that proof of verification on the blockchain work, and mechanism..... If I've missed the analysis of that allegation, please point me there.

So yeah, not quite sure if it's my ignornace, or the facts presented above, but yeah, My trust is lacking.

11. You've read the agreements on the Kinesis web site that say metal is titled to the holders, but now you're not sure that you believe them.

You're not sure Kinesis can be trusted because they've got a different entity for each different regulatory regime where they're trying to do business, while companies like Citigroup have...hundreds of sub-companies and that's fine?

I have read, and re-read, the TOS. Without getting sidetracked into other issues (such as the fiat/Crypto CEX components of Kinesis) Yes you're on track here. Because I have no Idea of the Legal/Lawfull structure of the Business, nor the specifics of the Baille/Bailor agreement that the web site says titles to the holders.

Here's a Due Deligance exercise I would suggest for you, and could prove a valuable contingency plan.

Imagine if you will, you have thousands of Kau, thousands of Kag, Thousands of Fiat invested in KMS

( maybe you do), and to your large surprise when logging onto KMS you get a 404, you find ABX is faced with insolvency, with tens of millions of dollars of debt, with no rescue available. What is the First thing you will do? How are you going to recover your investments? What is your path,what will be your recourse?...... 388

12 I don't understand the apparent cognitive dissonance.

The world is filled with it, but I have none here.

13. This isn't meant as an attack.

Thanks, I know that. We have a verge in opinion, that's all. I appreciate your enthusiasm and many insights. (Not so much your choice of college ball teams)

14.But I'm not sure what Kinesis can say or do to provide you the assurances and comfort you're looking for.

I'm not either. I hold slim hope, but will watch and wait and see what gets delivered. My Participation in the future is not completely out of question...

Take care, I'm out..

medium.com

medium.com

medium.com

medium.com

medium.com

medium.com

medium.com

medium.com