Loading my Kinesis data into cointracking.info for tax reporting

-

Short guides to forum navigation, searching, posting, translation, alerts and notifications viewable by clicking here.

-

Türk dostlarımıza hoş geldiniz Giriş burada.

-

Scammers are running ads on Facebook and Instagram claiming a giveaway. DO NOT OPEN THESE LINKS AND LOG IN. See this thread: here

Scammers are running ads on Facebook and Instagram claiming a giveaway. DO NOT OPEN THESE LINKS AND LOG IN. See this thread: here

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Loading my Kinesis data into cointracking.info for tax reporting

- Thread starter Uchiki

- Start date

eN_Rich

Member

Hi Uchiki, thanks for another well structured guide for Cointracking.

Question: How do you set an end of tax period price for KAU, KAG KVT?

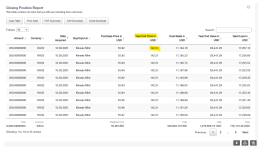

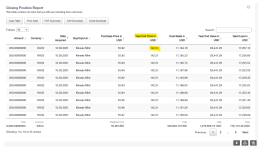

I have set custom prices for KAU, KAG & KVT and deselected best price, so Cointracking now uses the price for the current Exchange Balance.

The issue is the 'Balance by day' report shows their price varying very erratically day by day

Also the Tax report shows closing balance price is almost double the custom price I entered, and much larger than any purchase price. I am trying to finalize a prior year tax report, so any thoughts on fixing coin prices at a certain date would be appreciated.

Question: How do you set an end of tax period price for KAU, KAG KVT?

I have set custom prices for KAU, KAG & KVT and deselected best price, so Cointracking now uses the price for the current Exchange Balance.

The issue is the 'Balance by day' report shows their price varying very erratically day by day

Also the Tax report shows closing balance price is almost double the custom price I entered, and much larger than any purchase price. I am trying to finalize a prior year tax report, so any thoughts on fixing coin prices at a certain date would be appreciated.

Once the coinmarketcap integration of KAU/KAG/KVT is done, cointracking should be able to pick up the price automatically.

This should provide accurate pricing for the end of year report and also for the Income records.

Until then, the end of year report is tricky.

One possible approach is to export that part of the report to Excel and input the correct prices into your Excel sheet.

This should provide accurate pricing for the end of year report and also for the Income records.

Until then, the end of year report is tricky.

One possible approach is to export that part of the report to Excel and input the correct prices into your Excel sheet.

I have set custom prices for KAU, KAG & KVT and deselected best price, so Cointracking now uses the price for the current Exchange Balance.Hi Uchiki, thanks for another well structured guide for Cointracking.

Question: How do you set an end of tax period price for KAU, KAG KVT?

I have set custom prices for KAU, KAG & KVT and deselected best price, so Cointracking now uses the price for the current Exchange Balance.

The issue is the 'Balance by day' report shows their price varying very erratically day by day

Also the Tax report shows closing balance price is almost double the custom price I entered, and much larger than any purchase price. I am trying to finalize a prior year tax report, so any thoughts on fixing coin prices at a certain date would be appreciated.

Where do you see a button to deselect best price? They only place I see that is on the 'create a new tax report' page. Is that what you are referring to?

eN_Rich

Member

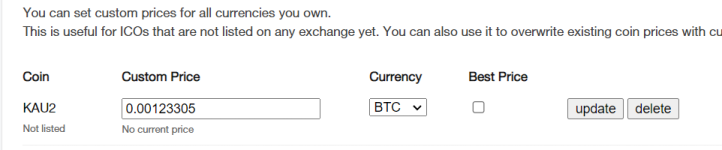

Cointracking: To deselect best price and set (enter) a coin price:

Enter Coins - Bottom RHS of page, under Summary is More

Enter Coins - Bottom RHS of page, under Summary is More

- Set custom prices (this seems to set current price)

Last edited:

I see; part of the issue is this confusion with KAURI also being labelled as KAU. CT support has suggested that I do a bulk edit to KAU2 which will then act just like KAG; testing this now. Too many potential errors with KAURI auto populating fields

There is a hidden link they sent me that leads to yours; it sets a custom price. The problem when I test this is that it's not showing correctly in the closed position report which is what I'm after as that is where reporting is incorrect. They are looking at it now bc the test we set was for a custom price of $60. This however is showing $142

Will post here once they get back to me

There is a hidden link they sent me that leads to yours; it sets a custom price. The problem when I test this is that it's not showing correctly in the closed position report which is what I'm after as that is where reporting is incorrect. They are looking at it now bc the test we set was for a custom price of $60. This however is showing $142

Will post here once they get back to me

eN_Rich

Member

Reply from Cointracking. When you set custom price in something different than BTC we convert the price to BTC by the current exchange rate. We even change it automatically every 10 mins.

So when you set it to USD it actually is saved in BTC value which is updated constantly.

Now, if you generated tax report for previous years we will take that BTC value and USD exchange rate from the end of the previous year. It could be lower or it could much higher than it is now.

The solution for now is to set a custom price in the right BTC value for the moment at the June, 30th (AUS) for all your custom price coins.

I assume this implies you need to run your Tax report immediately after setting coin custom prices, and will check this tomorrow.

So when you set it to USD it actually is saved in BTC value which is updated constantly.

Now, if you generated tax report for previous years we will take that BTC value and USD exchange rate from the end of the previous year. It could be lower or it could much higher than it is now.

The solution for now is to set a custom price in the right BTC value for the moment at the June, 30th (AUS) for all your custom price coins.

I assume this implies you need to run your Tax report immediately after setting coin custom prices, and will check this tomorrow.

I just got a similar response; mine was set around $58.73 for KAU2 attempting to run a tax report for EOY 2021. 'm not really sure how to set the custom price in the "right BTC value"...perhaps figure a price in BTC for $58.73 on 12/31/21 and then run the tax report immediately. Will try this tomorrow

eN_Rich

Member

Cointracking continually modifies the "custom price" you set for a coin as they assume it varies in price in line with the BTC price.

To Set a final EFY holding price KAU, KAG, KVT for closing values in a tax report.

e.g for KAU

1. Lookup the End Fin Year (EFY) Price for KAU

2. Multiply KAU (EFY) price *( BTC EFY price / BTC price now)

3. Now manually enter this value as the coin set price, deselect Best price & update

I found it better to value coins in my native currency AUD than USD (have not tried pricing in BTC)

The tax report will now have coin values close to the actual EFY coin prices, however as the BTC price moves, the Tax report closing values will move.

This sets approximate values for your Tax report - your current balances will definitely not be correct.

It is not an exact science

To Set a final EFY holding price KAU, KAG, KVT for closing values in a tax report.

e.g for KAU

1. Lookup the End Fin Year (EFY) Price for KAU

2. Multiply KAU (EFY) price *( BTC EFY price / BTC price now)

3. Now manually enter this value as the coin set price, deselect Best price & update

I found it better to value coins in my native currency AUD than USD (have not tried pricing in BTC)

The tax report will now have coin values close to the actual EFY coin prices, however as the BTC price moves, the Tax report closing values will move.

This sets approximate values for your Tax report - your current balances will definitely not be correct.

It is not an exact science

Last edited:

Simpler just to download the End of year section to Excel and enter the end of year fiat prices?The tax report will now have coin values close to the actual EFY coin prices, however as the BTC price moves, the Tax report closing values will move.

This sets approximate values for your Tax report - your current balances will definitely not be correct.

It is not an exact science

Your formula did not quite work for me, although I may be misunderstanding it. What I did was take the EOY KAU value of $58.73 and divide the EOY Bitcoin value of $47,630 into that to get a Bitcoin price of 0.00123305.Cointracking continually modifies the "custom price" you set for a coin as they assume it varies in price in line with the BTC price.

To Set a final EFY holding price KAU, KAG, KVT for closing values in a tax report.

e.g for KAU

1. Lookup the End Fin Year (EFY) Price for KAU

2. Multiply KAU (EFY) price *( BTC EFY price / BTC price now)

3. Now manually enter this value as the coin set price, deselect Best price & update

I found it better to value coins in my native currency AUD than USD (have not tried pricing in BTC)

The tax report will now have coin values close to the actual EFY coin prices, however as the BTC price moves, the Tax report closing values will move.

This sets approximate values for your Tax report - your current balances will definitely not be correct.

It is not an exact science

I then entered that into the box and the tax report is now looking right; the main thing I wanted to fix was the closing position report . Then end of year price in USD is showing $58.82...close enough.

Now, I'm interested to know if the tax report will still randomly change with this method because strangely before when I did it in KAU, the values in the actual tax report also changed which is REALLY odd to me. It should be a static snapshot report that can't be altered manually or automatically. So far after about an hour, the report is staying the same.

So all good

So all good

It is nice to have a formal report that one can show was not editable. I'm ok with using a modified excel if I have to. Part of my position is feeling that CT should have a solution for this issue; and they do...although I still think it's pretty clunky using the BTC price.Simpler just to download the End of year section to Excel and enter the end of year fiat prices?