Hi all.

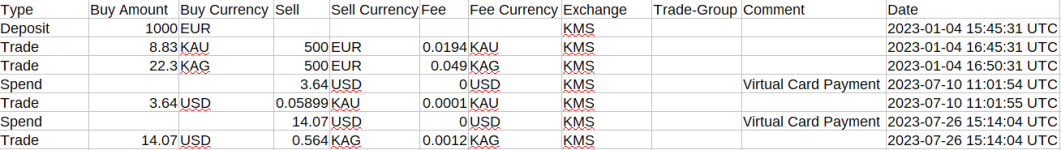

I'm an American living in Sweden. In 2024 on several occasions I moved EUR to Kinesis and purchased metals, using the swift, cheap method available via my Nordea account (SEPA? The one with .030 EUR transaction). As soon as the money arrived on the exchange I spent it all immediately purchasing KAUs or KAGs.

On the other side of the exchange I only made two or three small purchases with my VDC before that convenience was put on hold. So other than income from monthly yields, the only gains realized were on a couple fractional KAG sales for coffee and an ebook.

I always keep track of the EUR-USD exchange rate when I make a purchase from EUR to KAU or KAG. Evidently, Cointracking does not take this into account. On my first pass through the Tax Report feature it shows no USD cost basis on any of my KAG or KAU purchases. As a result all the metal I purchased and still have in my holdings looks like a REALIZED gain as far as Cointracking is concerned, and short term at that.

I haven't yet tried massaging the downloaded file, adjusting it with the exchange rates I recorded at the time of sale. Before I go down that hole I was wondering if there is an easier solution. (I'm using the free version)

I'm an American living in Sweden. In 2024 on several occasions I moved EUR to Kinesis and purchased metals, using the swift, cheap method available via my Nordea account (SEPA? The one with .030 EUR transaction). As soon as the money arrived on the exchange I spent it all immediately purchasing KAUs or KAGs.

On the other side of the exchange I only made two or three small purchases with my VDC before that convenience was put on hold. So other than income from monthly yields, the only gains realized were on a couple fractional KAG sales for coffee and an ebook.

I always keep track of the EUR-USD exchange rate when I make a purchase from EUR to KAU or KAG. Evidently, Cointracking does not take this into account. On my first pass through the Tax Report feature it shows no USD cost basis on any of my KAG or KAU purchases. As a result all the metal I purchased and still have in my holdings looks like a REALIZED gain as far as Cointracking is concerned, and short term at that.

I haven't yet tried massaging the downloaded file, adjusting it with the exchange rates I recorded at the time of sale. Before I go down that hole I was wondering if there is an easier solution. (I'm using the free version)

Last edited: