-

Short guides to forum navigation, searching, posting, translation, alerts and notifications viewable by clicking here.

-

Türk dostlarımıza hoş geldiniz Giriş burada.

-

Scammers are running ads on Facebook and Instagram claiming a giveaway. DO NOT OPEN THESE LINKS AND LOG IN. See this thread: here

Scammers are running ads on Facebook and Instagram claiming a giveaway. DO NOT OPEN THESE LINKS AND LOG IN. See this thread: here

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

[Info] All trading pairs on KMS Exchange

- Thread starter ZürichGnome

- Start date

ZürichGnome

Active member

Troglodytes

Well-known member

- Location

- U.K.

To be clear: crypto trades also contribute to the MFP. For example, if a user moves in US$ and uses it to buy BTC, or he converts BTC to ETH, the fees he pays will be 50:50 converted to KAU:KAG and enter the fee pool. That's why we love crypto folks too!14 fee currencies

At some point these must presumably be converted to KAG or KAU to make up the Master Fee Pool

The cool thing is that not only KVT holders, but also passive KAU and KAG holders benefit when users trade crypto on the Kinesis Exchange! Making KAU and KAG superior money

ZürichGnome

Active member

I drew the above as a directed graph.

Not quite right.

If you can trade A-B by buying A with B,

you can also sell B to get A.

[Edit: a bit of tautology that was. How about a re-write? ]

A-B trading pair

This is approximately right as currently we can't go from KVT to USD. But broadly it seems to be true at KMS Exchange.

So we might as well represent the same graph with simple edges instead of arcs.

Here we go:

Not quite right.

you can also sell B to get A.

[Edit: a bit of tautology that was. How about a re-write? ]

A-B trading pair

- buy A with balance in B or

- buy B with balance in A

- sell B to buy A or

- sell A to buy B

This is approximately right as currently we can't go from KVT to USD. But broadly it seems to be true at KMS Exchange.

So we might as well represent the same graph with simple edges instead of arcs.

Here we go:

Last edited:

ZürichGnome

Active member

21 Vertices

109 tradeable pairs

In combinatorics,

The complete graph on 21 Vertices has 441 edges

Subtract the loops (AED AED, for example)

-21

420

One direction only?

210

109 tradeable pairs

In combinatorics,

The complete graph on 21 Vertices has 441 edges

Subtract the loops (AED AED, for example)

-21

420

One direction only?

210

ZürichGnome

Active member

109 tradeable pairs

218edges if you count both directions

arcs notedges actually

Edges are not directed.

Arcs are [Edit. Duh!]

This prompts the question what does the complement graph looks like?

420 - 218 = 202 [Edit]

210 - 109 = 101 [Edit #2]

We're looking for those 101 edges that are not in the main trading pair graph.

The 101 non-tradeable pairs [Edit #3]

Amazingly this didn't take too much work. OK, it might be completely wrong. In which case, someone can point out my errors here.

218

arcs not

Edges are not directed.

Arcs are [Edit. Duh!]

This prompts the question what does the complement graph looks like?

420 - 218 = 202 [Edit]

210 - 109 = 101 [Edit #2]

We're looking for those 101 edges that are not in the main trading pair graph.

The 101 non-tradeable pairs [Edit #3]

Amazingly this didn't take too much work. OK, it might be completely wrong. In which case, someone can point out my errors here.

Last edited:

ZürichGnome

Active member

the fees he pays will be 50:50 converted to KAU:KAG and enter the fee pool.

Interdasting...

Taking a slightly different example:

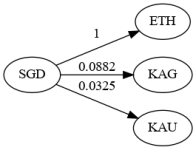

Assume we go from SGD to ETH

Specifically

buy

1 ETH with 2460 SGD

generating a 0.22% KMS fee

In pseudo-code,

- buy 1 ETH

- calculate fee

- allocate fee 50:50 to KAG

- allocate fee 50:50 to KAU

In the origin currency SGD:

In the destination currencies ETH, KAG and KAU:

Detailed calculations and GraphViz generation here

All hail Bell Labs -> AT&T Labs

ZürichGnome

Active member

OK, it might be completely wrong. In which case, someone can point out my errors here.

I tell you what. That last graph really is completely wrong

10 seconds thinking shows us that.

Example:

CHF-EUR is not a tradeable pair.

Thus we want to see that in the complement graph of NonTradeablePairs.

It's not there. Top right. Around one o'clock in the graph.

I'll post 3 different versions of a corrected complement graph. They all look cluttered because they are digraphs with arcs going both ways. CHF-EUR and EUR-CHF.

One day I'll have to figure out a way of transforming this directed graph into its accompanying undirected graph. To reduce the clutter.

In English, how to reduce the 202 arcs down to 101 edges. Can no do currently. Can't see how cheaply.

Work at github as usual here:

Using Graphviz force-directed layout algorithm:

Using Graphviz standard layout algorithm:

ZürichGnome

Active member

I stumbled upon the R igraph package.

Creator (?) and developer:

Gabor Csardi

This allows us to undirect the directed graph with 202 arcs into a simpler graph with only 101 edges.

Not trivial. Quite a bit of dancing required.

My work is documented here.

My work is documented here.

I hope this is now correct

The complement of KMS Exchange trading pairs:

The 101 non-tradeable pairs ...

At the top of this thread, we started with the 109 tradeable pairs.

Creator (?) and developer:

Gabor Csardi

This allows us to undirect the directed graph with 202 arcs into a simpler graph with only 101 edges.

Not trivial. Quite a bit of dancing required.

I hope this is now correct

The complement of KMS Exchange trading pairs:

The 101 non-tradeable pairs ...

At the top of this thread, we started with the 109 tradeable pairs.