There are a few elements to consider

The larger the amount, the more important the spread. The available liquidity may also be an issue.

A faster transfer will reduce the effect of volatility (there's less time for the price to move).

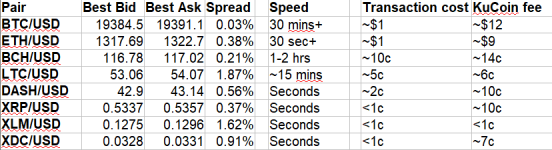

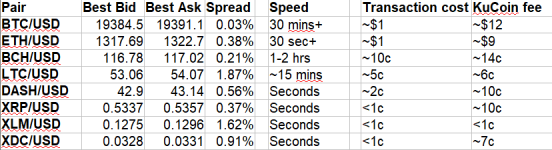

I've prepared some sample spreads below based on the crypto/USD pairs as of today.

Speed is the network speed. It will take longer than this to show up in your KM account.

eg for BTC, ETH, BCH and LTC two network transactions are required.

Transaction cost is the network cost ie if you are sending from your own private wallet.

If transferring from an exchange, it can be significantly higher than the base network cost.

For illustration, I included the withdrawal fees from KuCoin.

While XLM and LTC have the lowest fees from our example external exchange, KuCoin, they also have the widest spreads at the Kinesis Exchange, so may not be the best choices.

BTC and BCH offer very tight spreads at the Kinesis Exchange, but their slow transaction speeds expose you to volatility, particularly if just using the crypto as a transfer mechanism.

These USD pairs will give some indication, but you might also want to look at the crypto/KAU and crypto/KAG pairs depending on your aim.

It's also worth looking at the crypto/USD and (KAU or KAG)/USD as doing two trades could be cheaper depending on the spreads. You might also have more liquidity for larger transfers by sticking with the -/USD pairs.

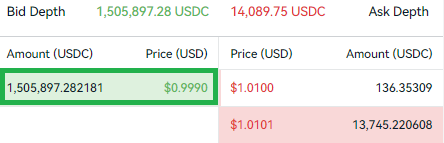

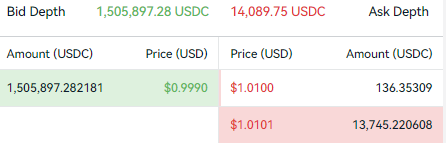

To check the spread, calculate the difference between the best bid and best ask and divide this by the best ask.

Ignore any small orders that happen to be the best bid or best ask.

If you are going to withdraw from an exchange to your private wallet and then on to Kinesis, then you will encounter a minimum balance that has to be left in your private wallet for XRP and XLM.

- the transaction fee to transfer in the specific crypto

- the spread for that crypto at the Kinesis Exchange

- the speed of deposit/volatility of the specific crypto

- the size of your transfer/trade

The larger the amount, the more important the spread. The available liquidity may also be an issue.

A faster transfer will reduce the effect of volatility (there's less time for the price to move).

I've prepared some sample spreads below based on the crypto/USD pairs as of today.

Speed is the network speed. It will take longer than this to show up in your KM account.

eg for BTC, ETH, BCH and LTC two network transactions are required.

Transaction cost is the network cost ie if you are sending from your own private wallet.

If transferring from an exchange, it can be significantly higher than the base network cost.

For illustration, I included the withdrawal fees from KuCoin.

While XLM and LTC have the lowest fees from our example external exchange, KuCoin, they also have the widest spreads at the Kinesis Exchange, so may not be the best choices.

BTC and BCH offer very tight spreads at the Kinesis Exchange, but their slow transaction speeds expose you to volatility, particularly if just using the crypto as a transfer mechanism.

These USD pairs will give some indication, but you might also want to look at the crypto/KAU and crypto/KAG pairs depending on your aim.

It's also worth looking at the crypto/USD and (KAU or KAG)/USD as doing two trades could be cheaper depending on the spreads. You might also have more liquidity for larger transfers by sticking with the -/USD pairs.

To check the spread, calculate the difference between the best bid and best ask and divide this by the best ask.

Ignore any small orders that happen to be the best bid or best ask.

If you are going to withdraw from an exchange to your private wallet and then on to Kinesis, then you will encounter a minimum balance that has to be left in your private wallet for XRP and XLM.

- For XRP, this is 20 XRP.

- For XLM, this is 1 XLM.

Attachments

Last edited: