This is fairly straightforward. Examples shown below for KAU/USD and KAU/AUD.

NB: These examples were taken over the weekend. The spreads will be tighter during the week.

Step1: identify where the larger blocks are in the order book. These will tend to be market makers, so they will be consistently there.

Step 2: Calculate the % spread between bid and ask.

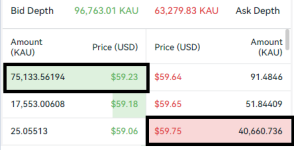

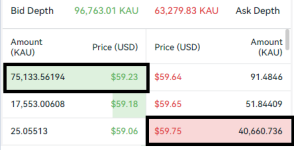

KAU/USD:

Step 1:

Step 2:

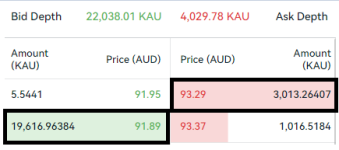

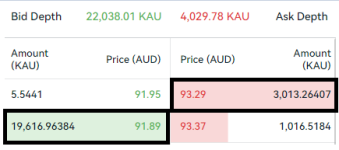

KAU/AUD:

Step 1:

Step 2:

What about the smaller blocks inside the market maker spreads?

These smaller blocks occur more often in the USD pairs (and they will tend to be for larger quantity), so you will often be able to get a better buy or sell when trading the USD pairs.

NB: These examples were taken over the weekend. The spreads will be tighter during the week.

Step1: identify where the larger blocks are in the order book. These will tend to be market makers, so they will be consistently there.

Step 2: Calculate the % spread between bid and ask.

- spread = ask - bid

- % spread = spread/ask (alternatively you could use spread/bid, just make sure you're consistent)

KAU/USD:

Step 1:

Step 2:

- 59.75-59.23=0.52

- 0.52/59.75=0.87%

KAU/AUD:

Step 1:

Step 2:

- 93.29-91.89=1.4

- 1.4/93.29=1.5%

What about the smaller blocks inside the market maker spreads?

These smaller blocks occur more often in the USD pairs (and they will tend to be for larger quantity), so you will often be able to get a better buy or sell when trading the USD pairs.

Last edited: