Thank you for this information in addition to the mint transaction fees. I just want to seek some clarification as I have been struggling away.

On the kinesis explorer website

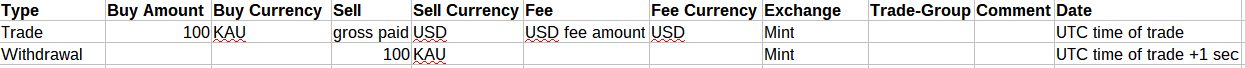

Payment = Cointracking trade usd to KAU/KAG 100 Kau

Withdrawal out mint on CT 99.5520Kau fee of 0.44799

Deposit into Kms 99.5520.

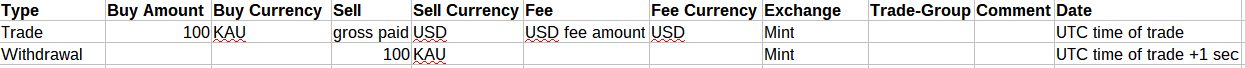

Some time back, the minting process was that 100 KAU was purchased with the minting fee being deducted from that, leading to (100 minus the fee) KAU being deposited in the KMS.

The process now is that 100 KAU is purchased with the 0.45% fee being added (charged in USD) and 100 KAU being deposited in the KMS.

So, it will be slightly different depending on whether you are looking at the new or old format.

I'd have thought all minting transactions being considered for recent reporting were now the new format.

I'll therefore outline that.

You should already have the Deposit record to KMS in the CSV file for 100 KAU (assuming new format).

Is this correct?

The other question is regarding Cointracking Trade Value

Say you make a Kau/Kag purchase with usd. The sale value auto populates. But the purchase value is empty do need to calculate the kau/kag value with usd?

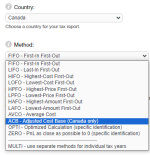

Trades of KAU or KAG against crypto or USD or other fiat should be fine as are.

Cointracking has enough information from the other side of the trade to value the KAU or KAG in your local currency.

Trades of KAU against KAG need to have a fiat value input.

It’s my understanding income and kag/kau trades need the value adding for each trade between pairs. And have used the fx tool to assist.

You need to enter a fiat value for Income records (see above for trades).

If you transfer kvt between personal Wallets ie CoolWallet/trezor without trading do you need to put withdrawal value for each deposit and withdrawal.

Such transfers are not disposals and are therefore not included in Capital Gains calculations.

Cointracking regards Withdrawals and Deposits as transfers between your own wallets.

It won't therefore matter if no value is input/available for these.

Thanks

Looking forward to the full tax solution. Because if you make a number of trades and are not doing accounts regularly it’s very stressful for a non professional.

Trades (unless you have KAU against KAG) will take care of themselves, so lots of VDC uses shouldn't be an issue.

Fiat values for the historic Income records do have to be entered, but more recent ones will automatically pick up a fiat value from coinmarketcap, so this should not be an issue once all of your reporting is for data after April 19th 2023.

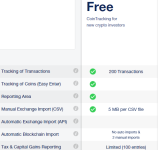

Referring to the recent quarterly update, Mint isn't part of the Q1 integration with Cointracking, but is planned.

docs.google.com

docs.google.com